If you still need assistance with your invoice, please contact us by chatting with Billing.

If you need to change who your invoice is sent to, you can follow these instructions.įor additional tax-related inquiries, please refer to these tax resources.įor any questions related to overages, please review the following links: This section will show any payments, credits, or refunds that have been made regarding this invoice, including the date of the transaction and the amount. Once a payment has been made or a credit has been applied to the invoice, you will find a Transactions section at the bottom of the invoice. Under the Tax Details section, you can find a breakdown of which of your products were charged tax, what type of tax it was, and the amount of tax charged.

If you have Net terms, you will need to open a billing ticket to apply that credit to an invoice. If you are on autopay, that credit will be automatically applied to future invoices. Note: If your invoice has a Total (Including Tax) listed in parentheses, ex. Your invoice balance is the amount that is currently due on the invoice.

Quick invoice pro upgrade#

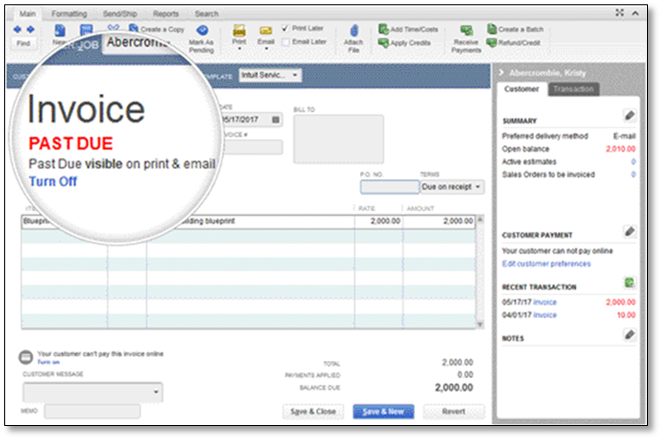

Can I upgrade or downgrade Yes You can upgrade from your free plan and unlock the PRO features as well as downgrade your PRO plan to the basic plan. You can still create unlimited invoices for those 3 customers. Your Invoice Totals will reflect your Subtotal (does not include tax), Total (including tax), and your Invoice Balance. The free invoice plan gives you access to most InvoiceQuick features but is limited to 3 active customers. In the Batch Invoice window, select the customers for whom you want to create batch invoices in QuickBooks Desktop Pro. Click the OK button in the message box that appears, if needed. Each product will include a Service Period, which is the period of time related to the charge. To create batch invoices in QuickBooks Desktop Pro, select Customers Create Batch Invoices from the Menu Bar. Under the Charge Details section, you will find all of your products, their quantities, and prices. If applicable, on the right side of your invoice, you can find remittance information, a PO number, and tax exemption information. Note: The billing contact and sold to contact email addresses listed on your invoice may not be the same as the account owner email address or your sign in email address. In the top-left of the invoice, you can find the date the invoice was generated ( Invoice Date), the Invoice number (always starting with INV), your Payment Terms, invoice Due Date, Account Number, Currency, Account Name and Address, and finally the billing contact and sold to contact address and email addresses on file.

Quick invoice pro how to#

Your invoice will reflect the products that are a part of your account’s subscription, including their quantity, price, and any applicable taxes.įor more information on how to view your invoices, please refer to the viewing your invoices article.

0 kommentar(er)

0 kommentar(er)